Indianapolis Home Sales Finish Strong in 2015

In spite of, or possibly as a result of the Fed’s anticipated (end eventual) decision to increase the short-term lending rates, the final quarter of 2015 gave the year a strong send-off, as the market ended to year with a record number of pended home sales. The Fed rate typically affects home mortgage rates, which is forecast to gradually increase in the coming months. We’re not sure.

In spite of, or possibly as a result of the Fed’s anticipated (end eventual) decision to increase the short-term lending rates, the final quarter of 2015 gave the year a strong send-off, as the market ended to year with a record number of pended home sales. The Fed rate typically affects home mortgage rates, which is forecast to gradually increase in the coming months. We’re not sure.

As we’ve noted in the past several months, the Indianapolis market’s major challenge is inventory of homes for sale. Increased demand, coupled with lower inventory is a boom for sellers, as homes are selling faster and average sale prices continue to increase.

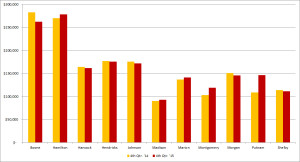

Challenges in inventory are reflected in the recent numbers. Across the nine counties surveyed, inventory of homes for sale was down 2.9%. Only three counties showed increases in inventory – Hamilton (+3.7%), Marion (+4.6%) and Shelby (+5.4%). Double-digit decreases are noted in seven counties, led by Putnam (-29.4%) and Montgomery (-31%).

The improvement in average sale price is noted by a slight 0.7% increase across our nine-county survey area, compared to the fourth quarter of 2014. Leading the way are Putnam County, with a 34.7% increase and Montgomery County, with a 15.6% increase over 2014. You’ll note that these two counties are the ones most challenged by inventory levels.

Looking forward, the continued inventory and potential mortgage rate challenges we might face have us expecting fairly “flat” or “stable” market conditions in 2016. In this case, flat to a record year is good news about an economy that continues to be gain strength.

The complete edition of Carpenter Reports and its data is available here. We hope it’s helpful in your understanding of today’s residential real estate market in central Indiana.